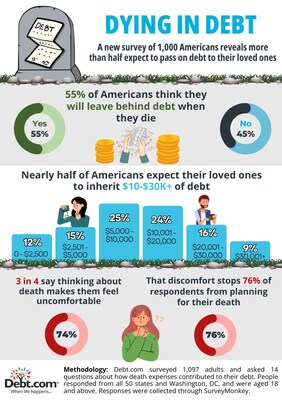

FORT LAUDERDALE, Fla., Nov. 19, 2024 /PRNewswire-HISPANIC PR WIRE/ — A recent survey by Debt.com reveals that more than half of Americans expect to pass on debt to their loved ones when they die, with many anticipating it will amount to tens of thousands of dollars.

The survey of 1,000 Americans found that nearly 1 in 2 respondents (48.66%) estimate they will leave behind $10,000 to more than $30,000 in debt.

“This survey shows that too many people are carrying debt that’s likely to impact their family’s financial future, with a significant number expecting to leave behind tens of thousands of dollars. This underscores the importance of financial planning and debt management now, so that families can focus on legacies, not liabilities,” says Don Silvestri, president of Debt.com.

Breakdown of debt inheritance expectations shows:

- 11.58% believe loved ones will inherit $0 – $2,500 of debt

- 15.27% believe loved ones will inherit $2,501 – $5,000 of debt

- 24.50% believe loved ones will inherit $5,001 – $10,000 of debt

- 23.83% believe loved ones will inherit $10,001 – $20,000 of debt

- 15.77% believe loved ones will inherit $20,001 – $30,000 of debt

- 9.06% believe loved ones will inherit $30,001 or more of debt

Additionally, 70% of respondents said they would take on debt to cover a family member’s funeral expenses, up from 55% in 2023. The survey further shows:

- 20% are willing to take on $2,001 – $3,000

- 18% are willing to take on $1,001 – $2,000

- 14% are willing to take on $501 – $1,000

Half of the participants reported taking on credit card debt after a loved one’s death, with 37% saying it caused them significant anxiety. “Most Americans don’t know which debts they inherit and which they don’t,” said Don Silvestri, president of Debt.com. “Death or planning for one’s death isn’t confusing; it’s just uncomfortable, so many of us avoid it entirely.”

The survey found that 74% of respondents are uncomfortable thinking about death, and 76% say this discomfort prevents them from planning for it. Only 41% of respondents have a written will, and just 33% have final expense insurance.

“Death is one of life’s certainties, so having the discussion with family and planning for end-of-life expenses can ease some of the suffering and grief for loved ones left behind,” Silvestri added.

The survey also indicates that Gen X is the generation most likely to expect they will leave debt behind when they die, followed by Millennials and Baby Boomers.

About Debt.com

Debt.com is a consumer website that provides resources for managing credit card debt, student loan debt, tax debt, credit repair, bankruptcy, and more. Debt.com partners with vetted and certified providers, offering expert advice and solutions for consumers “when life happens.”

Photo – https://mma.prnewswire.com/media/2561852/DCOM_Death___Debt_2024_Survey_Single_Chart_Infographic.jpg

Logo – https://mma.prnewswire.com/media/1576979/Debt_com_Logo.jpg

SOURCE Debt.com